Landscape Tree Market Outlook (July 2013)

By Timothee Sallin – President, Cherry Lake Tree Farm

The recovery of residential housing in Florida combined with a historic low in nursery tree inventories will create a significant tree shortage that is likely to last through 2017. This outlook discusses the primary drivers affecting the market for nursery trees and proposes a model for quantifying supply and demand of nursery grown trees over the next five years.

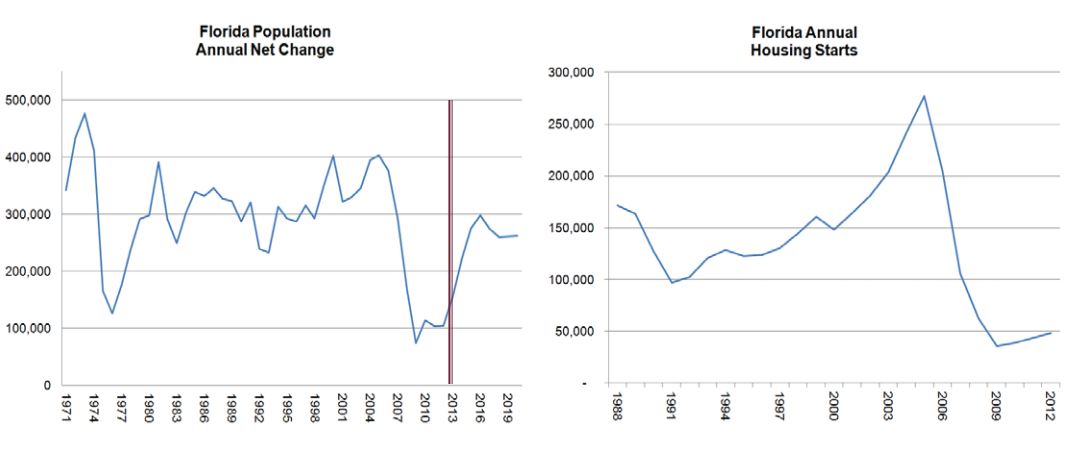

Population & Housing Fundamentals

Population growth is a primary driver of economic growth, construction and the demand for landscape trees. Since 1970 Florida’s population has grown every year. There was however, a significant drop in the rate of growth beginning in 2008 when Population Net Change fell to 167K from 292K in 2007. Population Net Change bottomed out in 2009 at 74K and has been slowly recovering since, reaching 104K in 2012.

The US Census forecasts that Florida population growth will reach 224K in 2014 and average 251K per year between 2013 and 2020. This suggests that Florida’s economy will be support by fundamentally sound population growth in the coming years.

These housing statistics suggests that the housing market has corrected itself and is now ready to return to more stable growth rates. Indeed, the first two quarters of 2013 have brought a significant increase in home builder activity and a rapid rise in housing starts.

Impacts on the Nursery Industry

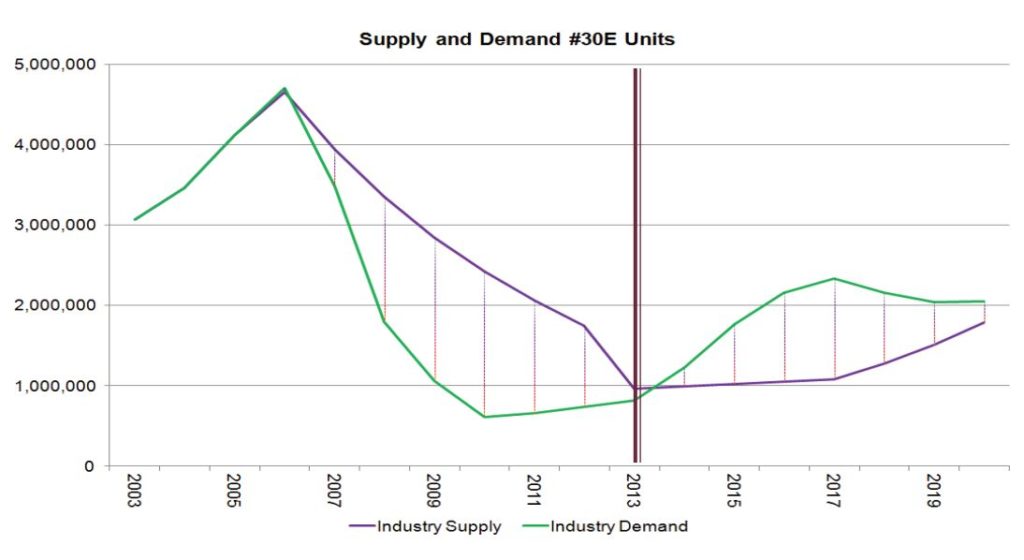

Fundamentals in the housing market may be returning to normal; however the extremes of the past ten years have caused a major disruption to the supply of plant material. The drastic fluctuations in demand for nursery products, driven by the swings in residential construction activity, have had a profound impact on the nursery industry. Unlike many manufactured materials, plant material inventories cannot adjust quickly to changes in demand. Production cycles for trees average 4 -6 years for standard sizes, and therefore supply cannot be increased in time to meet short or mid-term increases in demand.

Conversely, when demand decreases, nursery materials cannot be warehoused or stocked. Plants are perishable, have a limited shelf life and are expensive to maintain. This leaves the industry with few options in the event of a slowdown. Inevitably, a protracted decline in demand leads to inventory destruction and capacity reduction.

These unique challenges make it difficult to establish equilibrium between supply and demand of nursery products. When growth rates are stable and economic cycles mild, the disequilibrium is relatively minor causing only slight overages or shortages. However, when economic cycles are extreme, as in the past ten years, the effect on nursery supply is dramatic. We have seen supply swing, like a high arching pendulum, from a massive oversupply to a sudden and extreme shortage. Most significantly, the nursery supply is now out of sync with the construction industry and will likely require years to realign.

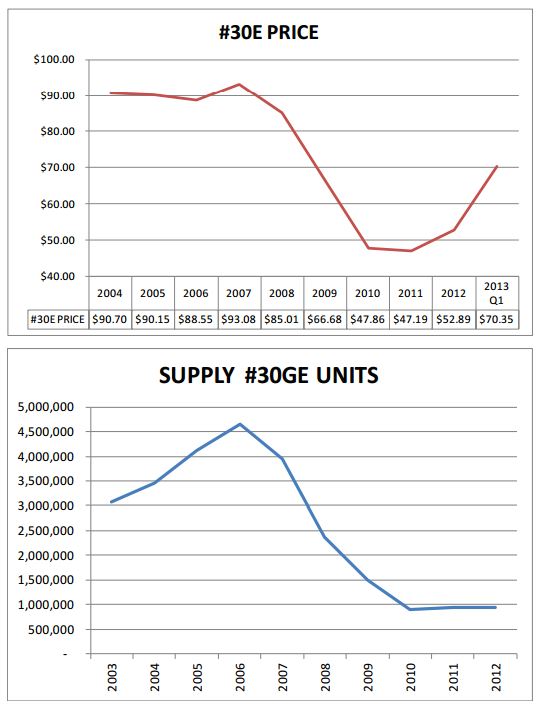

Price

The #30E Price of nursery grown landscape trees peaked in 2007 at $93.08. Following the decline in construction activity, price plummeted to a low of $47.19 in 2011 – a 49% decrease over 2007. This dramatic decline pushed market price well below production costs, and nursery growers booked negative margins for close to five consecutive years. After 2011, price began to recover gradually reaching $52.89 in 2012 and $71.32 in the first quarter of 2013. As of this writing, price remains below 2007 levels but is now rapidly increasing, having appreciated 48% in less than twelve months. Prices are expected to continue to rise for the foreseeable future. It is likely that prices will soon exceed 2007 levels and it is possible that we will see record highs well over $100 a #30E over the next several years.

Volume

Total Florida nursery grown tree inventories peaked in 2006 at 4,660,000 #30Es. After 2006, supply fell sharply to 900,000 units in 2010 – over 80% in four years. Since 2012, supply has increased slightly to 950,000 units.

What is the 30 Gallon Equivalent?

Production Capacity

A decrease in supply was the only possible adjustment in the face of the decline in demand. This decline in supply will have an enduring and fundamental impact on nursery production and output moving forwards because it was largely achieved through a reduction in production capacity. Production capacity is the underlying infrastructure required to produce trees – irrigation systems, holding systems and land.

As supply and demand fell between 2006 and 2011, nurseries stop planting new fields, abandoned existing fields, ceased maintaining critical infrastructure, and in many cases completely exited the market. Thus total production capacity of the industry has been critically reduced. Once production capacity is reduced it is very slow to rebuild as it requires heavy capital investment and time. Producers willing and able to make the capital investment today to expand their capacity will need to wait another 4-6 years for the inventories to mature. Thus there will not be any significant increase in the supply of plant material for at least 5 more years.

Supply Forecast

There will be a significant shortage of landscape trees over the next 5 year. We estimate current inventory to be approximately 950K units. Growth in supply will slow and steady over the next five years. Our model assumes a 3% annual growth rate through 2017. After 2017 we can expect a faster rate of growth as new investments expand production capacity.

Demand Forecast

The demand for nursery grown landscape trees is directly correlated to the number of housing starts. We estimate that for every Florida housing start, there is demand generated for 17 #30E trees. This captures the total demand for landscape trees including demand generated by non residential segments of the construction industry.

Based on this factor we can forecast demand for landscape trees by forecasting housing starts. Currently there are a number of reputable forecast for Florida Housing starts available, all of which project substantial growth in housing starts beginning in 2013. For example, the University of Central Florida’s Institute for Economic Competitiveness published the Florida and Metro Forecast 2013-2016 in December 2012. In this forecast they project Florida Housing Starts to be over 128,000 in 2013, 164,000 in 2015 and 185,400 in 2016. These numbers represent a 100%, 156%, 190% increase respectively over 2012 Housing Starts.

For our study we have chosen a more conservative methodology for forecasting housing start based on the US Census population growth projections. We have taken new population forecast and applied the factor of 2.16 new population per housing start to derive our forecast. This methodology yields 104K housing starts in 2014, 127K in 2015 and 138K in 2016. This forecast is significantly more conservative than the UCF forecast; nevertheless, as we will demonstrate below, even these lower levels of growth will lead to significant shortages in plant material.

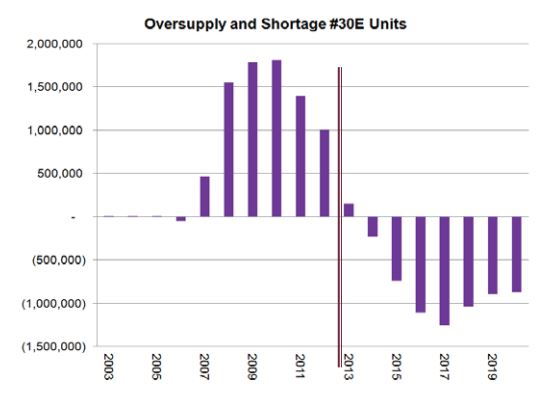

Forecasting the Shortage of Trees

Based on the supply and demand forecast presented above, it is possible to forecast the scale and magnitude of the upcoming shortage of landscape trees. This model shows that there will be a shortage of 232K #30E units in 2014, 738K units in 2015, 1.1M units in 2016 and 1.3M units in 2017. That is 19%, 42%, 51% and 54% of total demand respectively in each of those years. In other words, there will be twice as much demand as there will be supply. As mentioned above, this is likely a conservative forecast. If housing starts exceed our expectations, the shortage will be even more severe. At any rate, this projection raises serious questions as to how the industry will adapt to a situation in which demand is more than twice the supply. As it is not possible to manufacture more supply in time to meet the demand, it is likely that prices will rise significantly. Imports from out of state may increase; however, it is unlikely that imports alone will be able to impact the situation significantly as the national outlook is very similar to that in Florida. Inevitably, there will be unfulfilled demand.

Sourcing Strategies

Sourcing strategies for purchasing and securing plant material in an undersupplied market will be substantially different from those typically pursued in an oversupplied market. Consumers of landscape trees who understand this shift and adapt their sourcing strategies early will have a distinct advantage over the competition. Planning in advance and partnering with producers will become increasingly more important. Designing projects around available material will be critical. Producers and consumers will need to collaborate early in the design and planning stages of a project, in order to assure availability of material throughout the construction phases. Consumers and producers will benefit from developing strategic alliances and partnerships to navigate these challenges.

Looking Ahead

The next five years will be characterized by an extreme shortage of plant material and record high prices. These conditions will surely motivate growers to increase production, attract new capital and new entrants into the market, laying the foundation for the future growth of plant material supply and possibly the next major oversupply. The long production cycle for landscape trees means any major growth of the supply is at least 5 years away. By that time the housing market may be entering its next downturn. As the pendulum swings, it is possible that the nursery industry will remain out of sync with the housing market setting up another protracted oversupply down the road.

“The long production cycle for landscape trees means any major growth of the supply is at least 5 years away.”