Plant Market Update (September 2015)

By Timothee Sallin – President, Cherry Lake Tree Farm

In this Plant Market Update we will take a closer look at the dynamics of the housing recovery nationally and in the Southeast United States and how this recovery is affecting the market for plant material. We will also take a look at the agriculture and construction labor markets and discuss how rising wage rates combined with rising plant material costs are impacting the total cost of landscape construction projects in the Southeast.

Housing Market Recovery

The housing market has been recovering progressively since it bottomed out in mid 2010. Nationally home values are up 3.3% in Q2 2015, and inventory levels are down 6.5%. Rents are outpacing growth in home values, up 4.3% annually, growing one percentage point faster than home values over the last year.

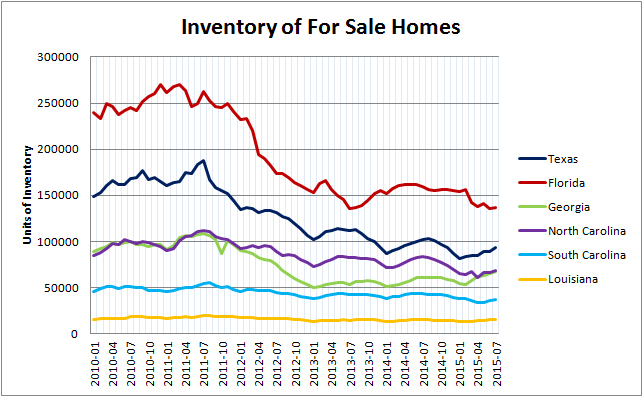

As rents continue to increase and the mortgage market remains favorable, more and more renters are looking to become homeowners. In fact, an estimated 5.2 million renters are looking to make the switch to home ownership. This is creating strong demand for new housing as inventory levels are low – down 6.5% from last year and 36% from their peak of 2.6 million homes in 2011. The inventory of bank owned properties (REOs) is also significantly reduced, clearing the way for new home construction and sales.

This is creating strong demand for new housing as inventory levels are low – down 6.5% from last year and 36% from their peak of 2.6 million homes in 2011.

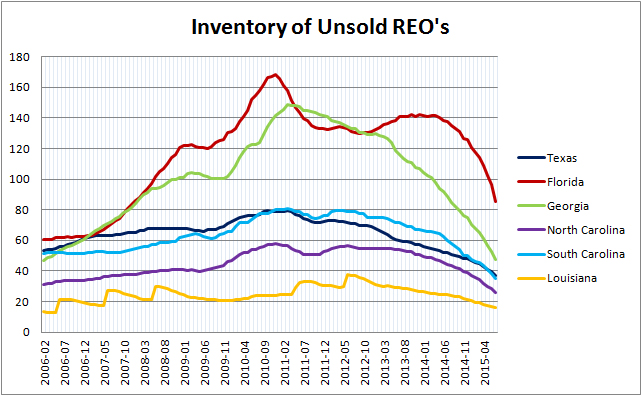

A closer look at the housing recovery dynamics in the Southeast and Texas reveals a similar picture to the national outlook with a few regional particularities. Florida is the most volatile market in the region while Texas and Louisiana have been relatively stable and are fundamentally healthy markets. Inventory levels are down significantly from their peaks, foreclosures, unsold REO’s and delinquencies are down, while home values are increasing at a slow to moderate rate.

Inventory levels in the region have come down significantly since their peak in 2010 and appear to have stabilized over the past 18 months. However, REO’s – bank or government agency owned inventory – have continued to fall precipitously over the last 18 months. Inventory of unsold REO’s has fallen to pre crisis levels for all states in the group except Florida and it looks like Florida will soon be at pre crisis levels if the recent trend continues.

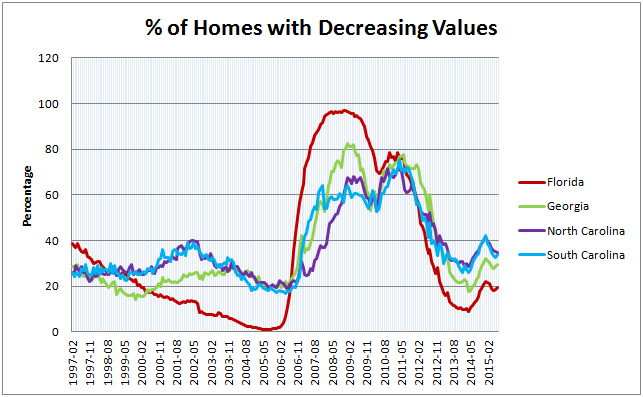

The reduction of bank owned inventory is an important indicator of the fundamental strength and health of the housing markets and a predictor of new home construction. Likewise the percentage of homes with decreasing home values in a market is a telling indicator of market health. This chart (see “% of Homes with Decreasing Values”) clearly illustrates the amplitude of the current cycle and the volatile behavior of the Florida market.

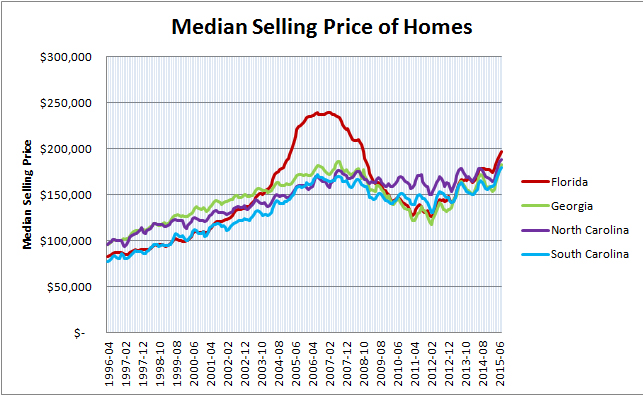

Home values have recovered to pre-crisis level and are now appreciating at a healthy rate. This is an encouraging sign as slow to moderate appreciation of home values combined with low inventory levels should promote fundamentally sound growth. In fact the the “bubble” in the housing market between 2004 and 2007 was driven by rapid inflation in home values in Florida. These increases in value were not tied to fundamental economic drivers and led to the housing market collapse. From this chart (see “Median Selling Price of Homes”) we can see how the bubble took shape and also see that housing values have returned to pre-bubble levels and continue to appreciate at historically normative rates.

What implications does this have for the plant material market?

The demand for plant material is closely correlated to new housing starts. In a previous plant market update, we estimated that each 1 housing start correlates to 17 #30 gallon equivalent trees. Currently demand for plant material created by growth in new housing is increasing at a faster rate than supply. This leads to disequilibrium in the market, increasing plant material prices and pervasive shortages of plant material.

The nursery industry simply cannot produce trees any faster than nature will allow. Nurseries are planting more trees in an attempt to respond to the growth in demand, but these trees will not be available for another 3 to 4 years. In the meantime, new construction projects are competing for a limited supply of trees and bidding the prices upward. As of this writing, plant material prices are nearing the historic high point reached in 2007 at the tail end of the housing boom.

This leads to disequilibrium in the market, increasing plant material prices and pervasive shortages of plant material.

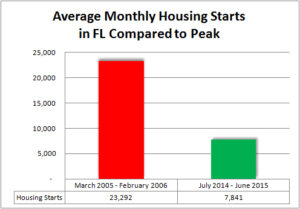

It is interesting to note that plant prices are approaching peak levels while housing starts are still less than 34% of 2006 peak levels. This is a reflection of just how much destruction of supply and production capacity occurred during the recession years. A significant number of producers exited the market and the total production acreage committed to nursery was substantially reduced between 2008 and 2012. Now we are experiencing severe shortages and price increases even though demand is still just a fraction of the demand present in 2006 and 2007.

Looking ahead, we can expect continued shortages and more price increases, as the housing market is poised to continue to grow and strengthen at a faster rate than plant material production. Three to four inch caliper oak trees will be the most difficult to source as these trees are typically required by codes and ordinances and very few substitutes and alternatives exist to meet the requirements.

While it is difficult to predict exactly how high and how quickly prices will rise, it is reasonable to expect tree prices to increase at least 25-35% over the next 2-3 years.

Labor Market and Wage Rate Inflation

Plant material prices are not the only input costs that are increasing. The labor market has also tightened significantly and labor wage rates have been rising as a result. It is likely that this trend will continue and we could be experiencing a structural economic shift in labor markets and wages.

As we have seen, the construction and housing industries are growing steadily creating significant demand for both skilled and unskilled labor. As the nursery industry gears up to fill the demand for plant material, they are increasing employment and drawing upon the same labor pool. Not to be left out, a strong tourism industry is adding significant labor demand as jobs are being created in the hotel, restaurant and service sectors.

Suddenly everyone is competing for the same labor and this is leading to significant wage rate inflation. The labor pool itself has been greatly diminished through the recession years as high levels of unemployment led to structural shifts in the labor markets. Many laborers exited the market by either re-training and integrating new industries, migrating to other regions, or in the case of immigrant labor, returning to their homeland.

According to demographer Chris Porter of John Burns Real Estate Consulting, there has been a 67% decline in immigration from Mexico and there are 570,000 fewer Mexico-born construction workers than in 2007. Significantly higher border enforcement, accelerated court order deportations, and adoption of the Federal E-Verify program by employers have made it increasingly difficult for immigrant labor to return. This results in a substantially reduced labor supply and increasing labor cost for agriculture producers, construction companies and tourism.

These industries have been increasing their utilization of Federal guest worker visa programs such as H2-A and H2-B to help fill their labor demands but these programs are costly and have contributed to increasing labor costs across the board. H-2 workers in Florida increased from 2,000 in 2006 to over 13,500 in 2014. Nationally, H2A workers increased from 59,000 in 2006 to over 116,500 in 2014. While these increases help to bolster the declining supply of labor, they are also driving up labor cost as the Department of Labor sets the wage rates for all guest workers and employers are required to pay for housing, transportation, and visa processing costs.

Implications for total landscape construction costs

Implications for total landscape construction costs

The two primary direct cost of any landscape construction budget are labor and plant material. As we have seen both of these inputs are increasing significantly. This is naturally driving the cost of landscape construction projects higher. Compounding the effect is the rational behavior of landscape company owners and estimators in light of these dynamic market trends.

On one hand input cost are increasing, leading to higher cost escalation risk. On the other hand the demand for landscape services is increasing as the overall economy begins to improve. Rational economic actors in these conditions will seek to increase their margins to offset the increasing risk and capitalize on the price elasticity of demand in a tightening market.

The bottom line is that labor cost, plant material cost and margins are increasing in landscape construction bids. This increases the overall cost of landscapes, which depending on your perspective, is either a good or a bad thing. Ultimately project owners and funders need to be aware of these trends so as to better anticipate costs and plan for their projects. Lump sum competitive bids may no longer be the wisest approach to buying-out landscape and irrigation scopes. More and more, we are seeing the most sophisticated project owners turn to alternative sourcing and contract models such as Integrated Project Delivery, Design Build, or other qualification based subcontractor selection mechanisms.

Whatever the approach, one thing is certain, landscape companies with access to the highest quality plant material and labor sources will prevail in the coming years.